Big 12 schools tapping the beer market

Published 6:00 pm Friday, May 11, 2018

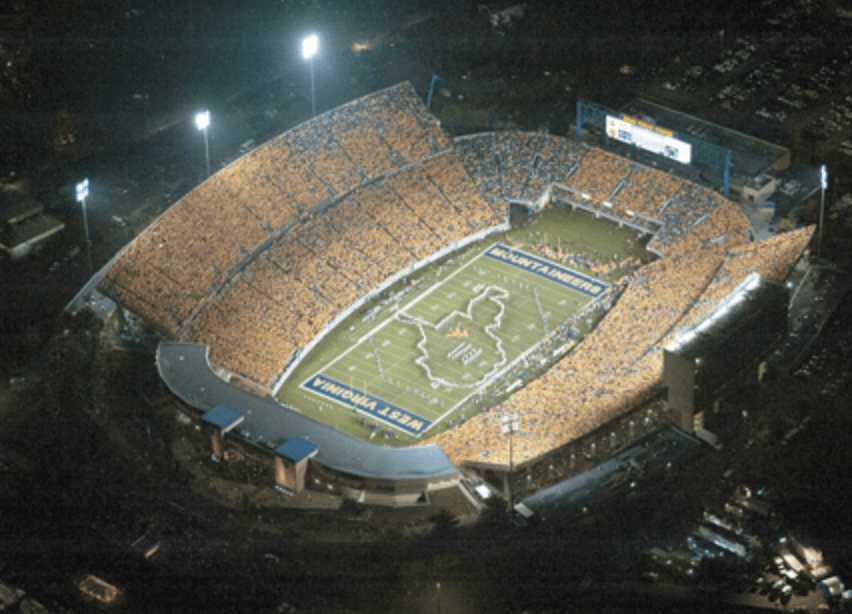

- The West Virginia Mountaineers play at Milan-Puskar Stadium in Morgantown.

What started as a guinea pig moment for West Virginia’s athletic department in 2011 has led to a growing trend among its Big 12 counterparts and colleges nationwide.

The previously touchy subject of public alcohol sales at college sporting events is becoming reality for programs attempting to keep up with revenue and fan enhancement challenges.

It wasn’t until 2013 when West Virginia left the Big East for the Big 12, but the new kids on the block have served as a pioneer of sorts. In the five years since, six of the 10 schools either have full-fledged beer programs to the public or are currently amidst an experimental pilot program stage.

“Somebody had to be the first to go out,” West Virginia athletic director Shane Lyons told CNHI.

“People wanted to make sure the model was going to work and you didn’t have additional problems. I think others were looking at their peer groups. I can’t speak for the others, but what I have at least heard is, using Texas as an example, theirs is doing extremely well. People are thinking it’s part fan enhancement, giving the fans an opportunity to have a beer during the games.”

A GROWING TREND

Lyons wasn’t at the forefront of the movement in 2011 — that title goes to Oliver Luck, a former West Virginia athletic director who now works for the NCAA — but Lyons helped the Mountaineers expand public beer sales to baseball and basketball when he took over the department in 2015.

The Longhorns followed suit in 2015 inside Daryl K. Royal-Texas Memorial Stadium. The move has proved lucrative.

Texas generated more than $3 million in revenue from alcohol sales at football games in 2017, said John Bianco, UT’s associate athletic director for communications. The school netted about $1.3 million of the sales, per its contract with concessionaire Sodexo (this doesn’t include sponsorships with MillerCoors and Corona that will add an additional $5 million, according to the Sports Business Journal).

Lyons, meanwhile, said West Virginia generated around $600,000 in beer sales based off a 52-48 commission split with Sodexo.

Earlier this month, TCU joined Oklahoma State and Kansas as the latest Big 12 schools to experiment with public alcohol sales. TCU announced it would serve beer for the Horned Frogs’ final seven home baseball games, while Oklahoma State is testing the market with sales at baseball and softball games.

Kansas Associate Athletic Director Jim Marchiony said in an email the school recently began a midseason spring pilot program at baseball and softball games.

TCU Athletic Director Jeremiah Donati wasn’t available for an interview — and TCU’s chancellor office didn’t respond to an interview request — but Chancellor Victor Boschini told TCU360.com he had conflicted viewpoints of the trial program.

“I worry about, in general, having alcohol available in the stadiums, any stadium, just because there are all these issues with it,” Boschini told the media outlet.

For years, stadiums and arenas have sold beer in restricted-access areas, mainly suite and club levels.

A 2017 study by Sports Business Journal reported 36 schools sell beer at football games on campus with an additional 14 off-campus.

David Jernigan, director of the Center on Alcohol Marketing and Youth at Johns Hopkins University, has studied youth alcohol trends for three decades. He referred back to the 1990s when universities pulled out of the beverage industry. Twenty years later, they are back in business.

“Alcohol is the great cofactor and people forget the kinds of problems it can create, particularly if it’s in situations where the distribution is not well-managed and the population to whom it’s being distributed is in a situation that can become volatile,” Jernigan said.

“The alcohol companies will always be there ready to knock on the door. The universities tend to see this as a way to make money.”

TACKLING FAN EXPERIENCE ENHANCEMENT

Those problems are the exact reason West Virginia started selling beer in the first place. Lyons recalled how West Virginia had problems with binge drinking at halftime when fans would leave the stadium, drink and re-enter. The solution? Eliminate re-entry and try to control consumption with in-house sales.

Lyons said he’s yet to receive a complaint from baseball or basketball games outside of one incident where a fan spilled a beer. Bianco said Texas hasn’t had any significant issues at football games.

Given how fans still drink heavily while tailgating, issues are still bound to arise. Inside, West Virginia has ways to regulate drinking with a two-beer maximum policy and a cutoff of sales after the third quarter.

Ultimately, it’s all part of a larger trend that involves pleasing fans in an era where conveniences such as 70-inch HDTVs, easy access to restrooms and the opportunity to down a few cold ones in your own home are becoming more attractive.

“It’s a matter of getting your fans to games, enjoying it and having some of the amenities you can have at home,” Lyons said. “Is revenue a part of it? Yeah, it is. But at the same time, it’s fan enhancement to having an enjoyable experience at your stadium and venues you sell at.”

This applies to places like TCU, Kansas State and Kansas where it’s less about revenue and more for the fans.

Four years ago, Kansas State tapped the beer market at baseball games. Unlike Texas and West Virginia, which have a contracted commission percentage, Kansas State receives a flat fee each year.

Scott Garrett, Kansas State executive associate athletic director, told CNHI that alcohol sales average $1,500 to $2,000 per game during a schedule of around 30 games. Kansas State receives an average upfront fee of $85,000, $33,000 of which comes from public sales at baseball games.

“It was really about providing a better fan experience and different options for folks that did want to buy a beer as part of their game-day experience,” Garrett said.

A BLUEPRINT FOR SUCCESS

CNHI polled the remaining four Big 12 schools if they had any plans to start experimenting with beer programs. Baylor and Iowa State said neither have had discussions nor plans to implement any public alcohol sales at its respective venues. Texas Tech said any alcohol-related programs would have to be approved by the Board of Regents and “at this time has not been discussed with that entity.” As of Friday afternoon, officials from Oklahoma hadn’t responded.

In an email to CNHI, Gary Shutt, Oklahoma State’s director of communications, said the school is still evaluating the pilot program and is not in a position to discuss the impact, benefits or future plans.

The blueprint is there should they decide.

West Virginia officials, from the athletic department down to campus police, helped Texas during the process. Lyons said Maryland and Ohio State consulted West Virginia for assistance. More recently, Kansas State handed data and information — like how to check IDs and additional security needed — to help TCU and Oklahoma State with its pilot program.

While beer sales at those programs may eventually expand, some schools are content with keeping it simple. Kansas State will continue to explore pre-game events and beer garden areas. Citing the family atmosphere at games, Garrett said there are no significant discussions about expanding public sales to football or basketball.

“We certainly hear that,” he said. “It’s Bill Snyder Family Stadium, and they don’t necessarily want that to be part of the environment.”

Still, the general consensus is beer sold to the public will continue to gain popularity across the country. The softening of alcohol has even reached the NCAA.

The nonprofit organization approved in April a proposal (2017-122) that eliminated the restrictions on alcohol at NCAA Division I championships. A waiver had been granted the previous two years for a beer and wine pilot program at championship events. The proposal cited favorable results and noted a decrease in law enforcement incidents.

“Alcohol cultures in the U.S. vary by state — I think you’ll still see state-by-state variation,” Jernigan said. “At the same time, these are incredibly competitive programs. You’ve got to expect that if one set of programs is perceived as getting a competitive advantage because they’re bringing in more money from alcohol that other programs are going to want to do it.”