Local News

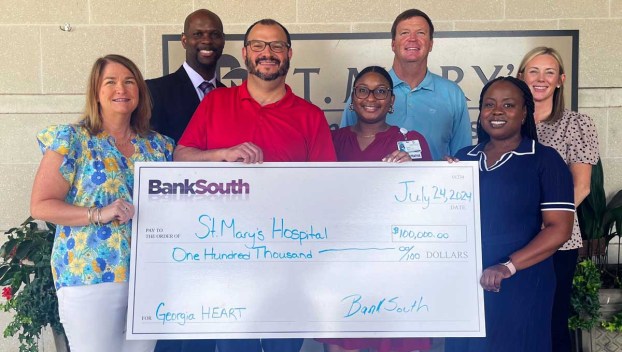

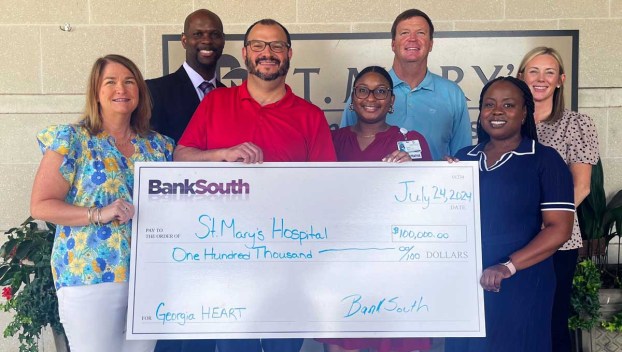

BankSouth donates $100,000 to St. Mary’s Good Samaritan Hospital through Georgia HEART

GREENSBORO, Ga. – BankSouth recently presented St. Mary’s Good Samaritan Hospital with a $100,000 donation through the Georgia ... Read more

GREENSBORO, Ga. – BankSouth recently presented St. Mary’s Good Samaritan Hospital with a $100,000 donation through the Georgia ... Read more

Hello Toni: I’m turning 65 and not planning to retire until I’m 70. I am a federal employee ... Read more

Toni: I need to make the right Medicare decision because I turn 65 in August and have not ... Read more